The largest of the publicly traded bitcoin mining companies has already filed for bankruptcy due to its unmanageable debt load, which totals more than $4 billion.

The largest public bitcoin miner by hashrate, Core Scientific, today declared bankruptcy after months of laboring under a mound of debt. Since many public miners owe huge sums of money to their creditors and are finding it more and more difficult to pay off debt, many may soon follow Core Scientific in filing for bankruptcy. Who owes the most money is revealed in this article's discussion of their debt loads.

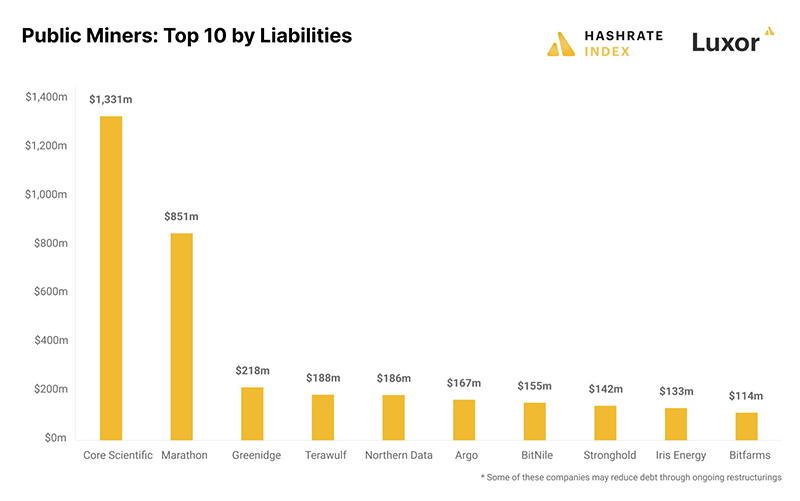

The biggest debtors are Marathon and Core Scientific.

Given that Core Scientific has obligations of $1.3 billion as of September 30th, it should come as no surprise that it owes the most money. The company has recently been unable to make the tens of millions in monthly debt service payments required by such a massive debt load since its cash flows have dried up along with the declining price of bitcoin and rising price of power. The company just filed for bankruptcy as a result.

Marathon, with $851 million in obligations, is the second-largest creditor. The majority of this debt is in the form of convertible notes, which do not require regular payments for debt servicing but do offer holders the chance to convert them to shares. As a result, Marathon's debt is manageable and the business is not in immediate danger of failing.

Greenidge is the third-biggest debtor. The $218 million in debt that the corporation owes is being restructured, which could greatly reduce that amount. Later in the article, I go into detail about this reorganization process.

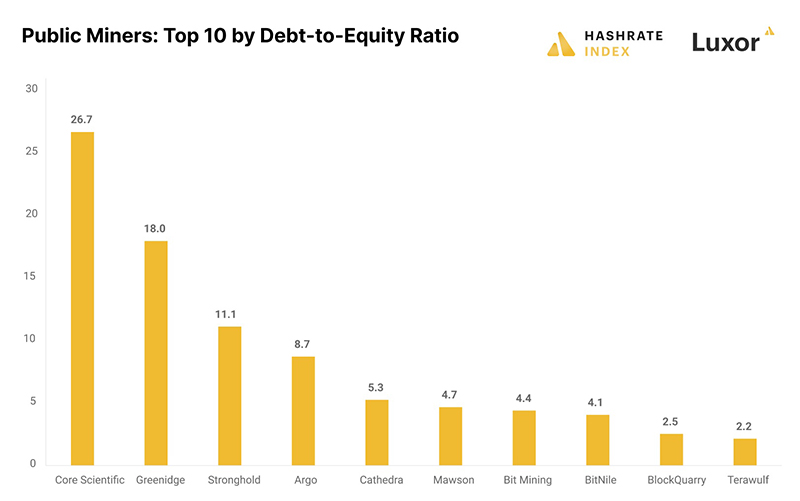

Numerous public mining companies have dangerously high debt to equity ratios.

The public miners' absolute debt levels were displayed in the previous section. However, as companies with high equity valuations have more room for taking on debt than their lower-valued counterparts, the most pertinent statistic is how high liabilities these companies have relative to their equity. As a result, I enjoy examining the debt-to-equity ratio.

In other businesses, a debt-to-equity ratio of two or greater is seen as dangerous, but in the infamously unstable bitcoin mining industry, it should ideally be significantly lower. We can see that many publicly traded miners have exceptionally high debt-to-equity ratios in the graphic below.

It's not surprising that Core Scientific has the highest debt-to-equity ratio of 26.7 given its enormous obligations. With debt-to-equity ratios of 18 and 11, respectively, the two power plant operators turned bitcoin miners Greenidge and Stronghold come in second. Additionally, Argo's debt-to-equity ratio of 8.7 is extremely high.

Around 25 people work as public bitcoin miners. A debt-to-equity ratio higher than 2 is regarded as dangerous even in far more stable businesses like consumer goods or agriculture, which accounts for nearly half of them. With liabilities totaling $4 billion and equity totaling $2.2 billion, the overall bitcoin mining sector has a debt-to-equity ratio of 1.8, which is relatively high when compared to most other industries. Going forward, there will probably be a lot more restructurings and possible bankruptcies because of the industry's leverage.

The debts of some public miners are being restructured.

Some bitcoin mining companies have unmanageable levels of debt, and some of them are making measures to restructure their debt. The majority of the time, these debt restructurings include converting debt into equity, although they can also entail selling off assets to settle obligations. I quickly outline a few of the debt restructurings currently occurring in the bitcoin mining sector in this section.

Core Scientific will be our first stop. On December 21st, the company declared bankruptcy due to its unmanageable debt load. Since the corporation will merely restructure its debt and not sell its assets, this bankruptcy is purely of a formal nature. The holders of convertible notes will likely hold 97% of the company's stock under the new corporate structure. This conversion of debt to equity will significantly reduce debt and enable the business to function.

Greenidge is attempting a financial restructure as well, but so far has stayed out of bankruptcy. The company and its machine lender NYDIG entered into a non-binding agreement on December 20th to restructure debt totaling about $74 million. By gaining ownership of the 2.8 EH/s of machines, NYDIG will eliminate the remaining debt that Greenidge owes. In order to better its financial situation, Greenidge will host these machines at NYDIG's facilities, effectively changing itself from a self-miner to a hosting business.

In order to lower its debt and increase liquidity, Argo, which just unintentionally published a bankruptcy notification, said it is negotiating to sell some of its assets and complete an equipment financing arrangement.

Conclusion

Some public miners are currently being haunted by the enormous debts they took on when circumstances were better. These businesses have struggled to pay off their debt as mining cash flows have declined, and many have been forced to reorganize. These restructurings frequently convert debt into essentially worthless equity, causing enormous losses for both equity and debt holders.

We will probably continue to see more restructurings and possibly some bankruptcies because the industry has unacceptably high amounts of debt. The stage of the cycle where the weak players are eliminated has begun to unfold.

Some public miners, however, barely have any debt. These businesses will prosper because they have the resources to purchase undervalued mining assets for pennies on the dollar. There are several expansion chances for the financially strong players as struggling corporations sell off their ASICs and mining operations.

👉Start Cloud Mining with us: MODENWORLD

👉Follow our official Twitter: @modenworld

👉Join our community on Telegram: @ModenWorld_group