Now that 2023 has arrived, we can put the terrible 2022 year for bitcoin mining in the past. We're all interested to see what this brand-new year will bring for the bitcoin mining business.

This year, what will the miners prioritize? What will happen to the public miners who are almost bankrupt? The most intriguing topic is how the price and hashrate of bitcoin might change in 2023.

These questions are addressed in this post by our top 10 bitcoin mining predictions for 2023.

1. The bear market in bitcoin will finish, but there won't be a full-scale bull market just yet.

The unpleasant truth is that the mining industry's most important influencing element is the price of bitcoin. So, we start off by attempting the seemingly insurmountable task of forecasting the price of bitcoin.

In the past, there have been some surprisingly similar bull and bear cycles for bitcoin. To predict how terrible and how long the current bear market might endure, it can be useful to compare it to earlier ones. In its 2022 year-end report, Arcane Research notes that the current bear market for bitcoin has lasted for 376 days, which is equal to the bear markets in 2014–15 and 2018.

The greatest drawdowns of 85% and 84% in 2015 and 2018 are likewise not far from the current peak-to-through drawdown of 78%. Historical cycles suggest that the current bear market will shortly come to a conclusion.

Furthermore, the collapse of a number of excessively leveraged market participants was the sole cause of the price of bitcoin falling below $25,000. The price of bitcoin would continue to fluctuate between $25,000 and $30,000. The price of bitcoin may return to these levels once the overleveraged dominoes have all fallen.

Although the bear market may eventually come to an end, it is still too early for a new bull market to start in its entirety. New money entering the market is what essentially drives the price increase of bitcoin. Few outsiders will probably start allocating capital to bitcoin and cryptocurrencies in 2023 as a result of the extreme market instability and outright frauds of 2022 scaring many people away from the industry.

Traditional financial institutions won't be ready to invest in bitcoin for a while, and we'll probably have to wait another year or two before market participants are ready to start the next bull cycle.

2. The rise of Bitcoin's hashrate will slow

As bitcoin miners finally carried out the big expansion plans they started during the bull market of late 2021, hashrate gradually increased in 2022. This year verified what we've seen over the course of multiple cycles in the past: Hashrate lags bitcoin's price by several months since it takes time to make mining rigs and construct sites.

Due to the poor mining economics of 2022, capacity expansion was not encouraged, hence it is expected that hashrate growth will slow down in 2023. Most of the hashrate that goes online in 2023 is a result of capacity expansion miners had originally intended to deploy in 2022. The first half of 2023 will see the online launch of this delayed capacity. After then, depending on the price of bitcoin, the hashrate will stop increasing and may even decrease.

3. As they merge or go private, the number of public Bitcoin miners will decrease.

Especially during bull markets, public Bitcoin mining companies have easier access to money than private ones. Public life, however, also has a number of drawbacks. The severe reporting requirements that public companies must adhere to, which may be time-consuming and expensive, are arguably their biggest burden.

Following a disastrous bear market, several publicly traded miners have been reduced to penny stocks with market capitalizations under $50 million, which hardly seem to warrant the exorbitant costs associated with yearly reporting. By going private, these businesses might significantly cut administrative expenses.

To share administrative costs and take advantage of economies of scale, some publicly traded miners will merge with other businesses rather than going private.

4. As infrastructure is put in place and miners are wiped out, hosting fees will decrease.

The (many) unfavorable developments of 2022) included growing hosting costs.

In North America, the mining industry in the US and Canada saw a surge in activity and funding as a result of the Bitcoin mining gold rush that was sparked by China's mining ban in 2021. The mining industry in North America was not prepared for the entry of Chinese company and the rise in interest in mining among North American investors.

Amble rack space was difficult to find in the North American market in 2021 and 2022 because infrastructure build-outs took time to respond to the shift. It was, in a sense, a market for hosting providers where the scarcity of rack space and increased demand allowed hosting businesses to charge higher prices. Additionally, in 2021 and 2022, electricity prices increased, which accelerated the rise in hosting expenses.

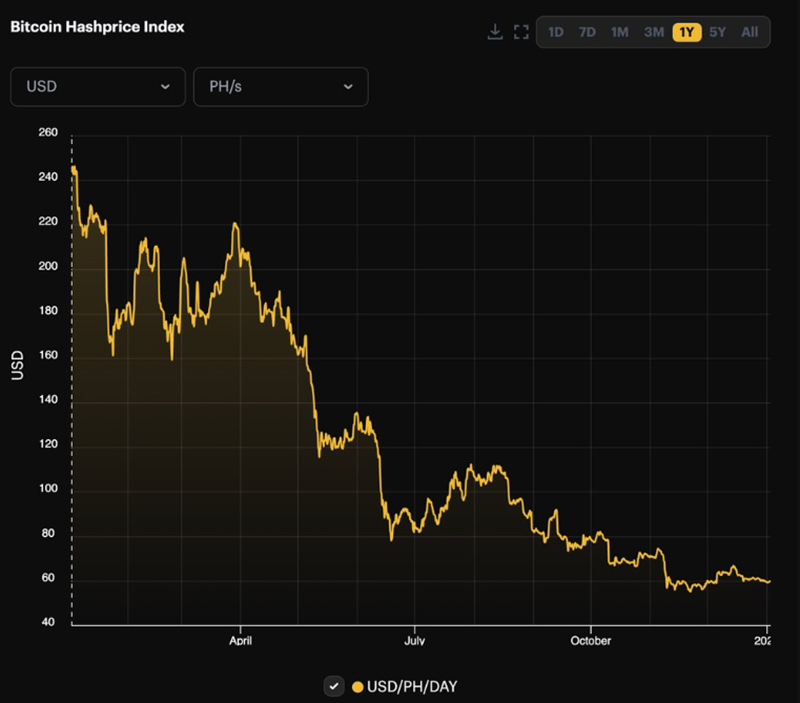

The opposing tendency will probably start to develop in 2023. Hosting companies will fight for customers in a considerably more unfavourable market climate as new build-outs eventually come online (hashprice is currently $60/PH/day, compared to 2021 and 2022's averages of $315/PH/day and $124/PH/day, respectively). Furthermore, many miners higher up the cost ladder are already working at neutral or negative margins because the breakeven cost of a 100 TH/s S19j Pro is $0.082/kWh at the current hashprice levels. Miners will see breakeven costs or negative margins even with average power/hosting rates if hashprice drops further from here, as we anticipate it will.

Hosting companies will have to cut their prices to stay competitive in 2023 given the dire situation of mining economics and the increase of competitors. In the unfavorable market situation of 2023, hosts who are unable to or have not been able to negotiate low enough power costs to retain their own margins will struggle.

5. In 2023, cutting costs will be the objective.

Due to the razor-thin profit margin in bitcoin mining, miners are strongly motivated to cut expenses. Miners will work hard to reduce operating costs in 2023.

As the largest component of a miner's operational cost structure, electricity will naturally be the expense that needs to be reduced the most. By locating their activities adjacent to stranded energy sources, assisting in the grid's balancing, or selling surplus heat, miners can reduce their electricity costs. Miners will have to upgrade their electricity use due to the current weak market.

Aiming to increase hashrate per unit of electricity spent, miners will try to increase the efficiency of their mining rigs in addition to lowering their all-in electricity costs. Others will underclock devices to increase productivity, while the miners with good access to finance will upgrade their older models to the Antminer S19 XP.

Cutting administrative expenses is the most significant immediate opportunity for cost reduction in the bitcoin mining sector, even if lowering electricity costs is the most important cost component to minimize over the long term. Over the past two years, many bitcoin miners, especially the publicly traded ones, have seen their administrative costs explode as the quick rise during the bull market disincentivised caution. These businesses will now cut back on executive pay and other administrative costs.

6. ASICs will become quite affordable, but next-generation machines will continue to be expensive.

Prices for ASIC are currently lower than they were at their peak in 2021 or even at the start of 2022. However, they are not low enough, and in 2023, they will drop much further (barring a sharp increase in the price of Bitcoin, of course).

An S19j Pro at $0.06/kWh would require 925 days to pay for itself even at current pricing (and that's the predicted ROI at the current hashprice, so the timescale will further lengthen if hashprice decreases from here).

Due to the challenging market conditions, next-generation equipment like the S19 XP is selling for more than current-generation rigs.

7. Given the continued high cost of electricity, many miners will struggle to maintain enough uptime.

As American miners modified the uptime of their equipment depending on quickly rising electricity prices, this year's hashrate volatility was quite high. The hashrate first began to decline significantly in the summer, when heat waves in the United States caused power rates to surge so many miners were forced to turn off their equipment. The same situation occurred in December, although that time, freezing weather rather than a heat wave was to blame.

With the Antminer S19 XP, the break-even electricity price for mining is currently nearing historic lows at around $0.1 per kWh, which means that even in electricity markets with generally low electricity prices, spot prices will frequently fluctuate above the mining break-even, forcing miners to turn off equipment.

Additionally, most markets around the world have rather high electricity rates. There is a chance that some miners using energy grids with quite high costs will be compelled to turn off their equipment more frequently than they would want, lowering their bitcoin production per EH/s. The comparison of the amount of bitcoin produced per EH/s will be more important for individuals who follow bitcoin mining stocks.

8. Regulators in some jurisdictions will continue to focus on the bitcoin mining sector.

In 2022, the regulatory burden on the bitcoin mining sector increased. To stop the sector from taking off, a few US states and Canadian provinces put various moratoria on bitcoin mining. While some legislators in the US federal government rattled their fists at bitcoin miners, most regulatory assaults took place at the state level.

It's likely that additional mining restrictions will continue to be implemented in some US states and Canadian provinces. The existing mining restrictions in some states and provinces may extend to other jurisdictions because regulators in one state will learn from their counterparts in other places. The fact that they are all controlled by Democrats is a characteristic of the US states that have adopted mining moratoria.

In the US and Canada, it is doubtful that any new federal regulations will be implemented in 2023.

9. The miners will try to improve their balance sheets.

The year 2023 will see a reorganization of the bitcoin mining sector. Numerous businesses, particularly some of the publicly traded ones, have dangerously high debt-to-equity ratios as well as extraordinarily high debt service costs compared to operating cash flows.

Some businesses can only restructure their debt due to unmanageable levels of debt. Negotiating lower interest rates or delaying the debt's due dates are also examples of debt restructuring. The debt may be converted to equity if the company's financial situation is exceptionally dire. Due to their dire financial situation, many bitcoin miners have no choice but to file for bankruptcy. An example of a miner using this strategy is Core Scientific.

Selling assets and utilizing the money to reduce debt is another strategy to improve a balance sheet. This process was recently used by Argo to pay off debt by selling its premier mining operation. In 2023, as bitcoin miners struggle to stay afloat, strengthening balance sheets will be a primary focus.

10. Bitcoin mining derivatives will be used by miners more frequently to safeguard fluctuating profits.

The year 2022 demonstrated how important risk management is to bitcoin miners. Bitcoin mining is a fiercely competitive, low-margin industry, with the exception of bull market peaks. Therefore, safeguarding cash flows is crucial for a bitcoin mining operation's long-term viability.

After the terrifying bear market of 2022, miners will improve their risk-management skills in 2023. A effective risk management strategy is all-encompassing and includes managing the treasury as well as using derivatives to hedge revenues and costs. Up until recently, miners could hedge the majority of cost and treasury components but not income. This changed in late 2022 with the introduction of Luxor's hashprice non-deliverable forward contract, which enabled miners to sell their future hashrate for a set hashprice.

Beginning in 2023, we will observe a trend of miners looking to hedge every possible exposure, as is typical of more established sectors of the commodity-producing economy.

Conclusion

For bitcoin miners who were abruptly required to adjust to a new and sad reality, 2022 was a startling year. Hopefully now that the shock has subsided, miners can adopt the prudent approach that will guide bitcoin mining in 2023.

By bolstering their balance sheets and cutting costs, miners will place a higher priority on enhancing the health of their operations this year. Some public miners will merge or become private as a result of cost-cutting efforts. The balance sheets of some miners may need to be reorganized, which may require selling assets to reduce debt or converting debt into equity.

In 2023, bitcoin mining will be shaped in part by the prudence megatrend, which will also see advancements in risk management. By selling hashprice NDF contracts and hedging electricity prices, miners will try to protect cash flows.

They assert that difficult circumstances produce powerful bitcoin miners. This old saying holds true, in our opinion, as the industry will emerge from the ashes stronger than ever.

👉Start Cloud Mining with us: MODENWORLD

👉Follow our official Twitter: @modenworld

👉Join our community on Telegram: @ModenWorld_group